In many cases, it may be necessary to file an SR-22 type with your state. Filing a non-owners SR22 insurance coverage type will not contribute to your automobile insurance coverage plan price, however the insurance firm may charge a. The following table supplies example auto-insurance rates for drivers in Southern The golden state. It compares and also supplies responsibility protection quotes for both an automobile owner and a non-owner.

You desire to contrast quotes zip code from at the very least 3 insurance policy firms to see who has the cheapest rate. Amongst the major service providers evaluated by Insurance coverage.

It supplies obligation insurance coverage if something occurs and covers you when you are at mistake for causing damages or injury to other people. It will not offer coverage for your very own injuries or damage that takes place to the cars and truck you are driving. What does a non-owner car insurance plan cover? Responsibility insurance policy covers injuries or property damages that you're lawfully liable for as a result of a car mishap.

If your state has demanded that you file an SR-22 or FR-44 financial obligation type, the state may determine what responsibility coverage quantity you ought to acquire. In particular states, non-owner car insurance can give medical or uninsured motorist coverage. Non-owner insurance does not consist of the following sorts of coverages: Comprehensive, Collision, Towing compensation, Rental repayment, Your non-owner responsibility coverage can be utilized as second protection if you borrow someone's vehicle and also remain in a car crash; the auto owner's vehicle insurance works as the primary insurance policy.

What Is Non-owner Car Insurance? - Auto - Usnews.com Fundamentals Explained

There are a few things that non-owner vehicle insurance does not secure against: You won't be covered if you're in a mishap that creates damages to the car you occur to be driving at the time. This means that if you borrow your friend's automobile as well as get involved in a minor car accident with another vehicle, the vehicle's proprietor can file a case under their own vehicle insurance coverage, or versus the various other driver's cars and truck insurance.

Non-owner car insurance policy only covers the individual that acquired it. If you are using your vehicle for work, like delivering packages, non-owners auto insurance coverage policy will certainly not cover you.

Some automobile insurer won't allow you to get a non-owner plan if there are a lot of key drivers and automobiles listed on a policy - accident. If a policy notes three motorists as well as 3 autos, and also you are just one of the drivers, you will certainly be provided as the key driver on the third vehicle and also won't be able to acquire non-owner cars and truck insurance policy.

Comply with these steps to purchase non-owners insurance coverage, Call an automobile insurance firm agent about the insurance coverage. If non-owners sr22 insurance coverage is needed, offer the representative with your state alert number (if relevant-- not all states need this).

Excitement About Non-owner Car Insurance - Foxxinsurance

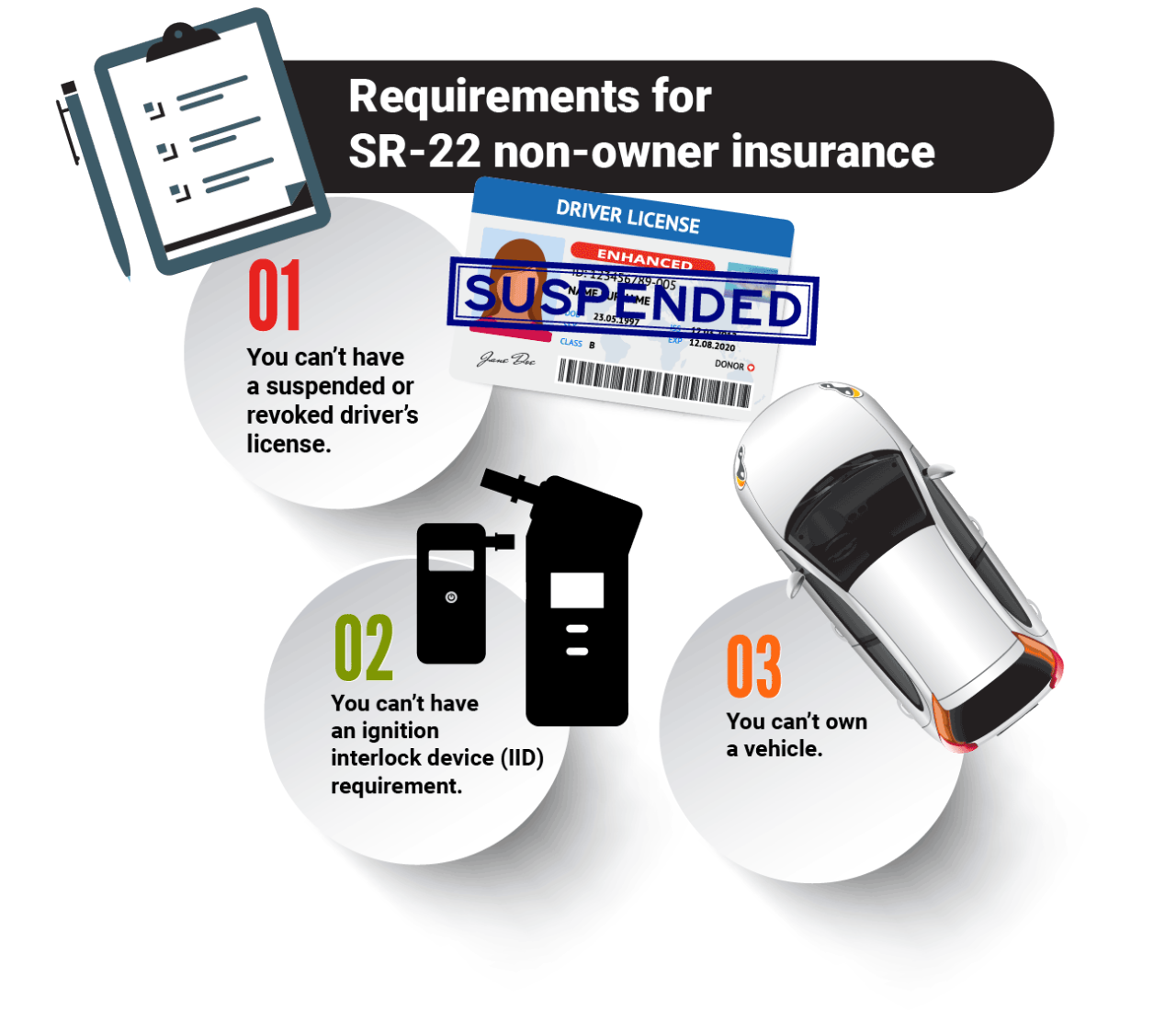

This implies that you have an economic passion in the automobile and will certainly lose cash if the vehicle suffers damage. It also reduces the danger of you dedicating insurance coverage fraudulence. What is Non-Owner SR-22 Insurance Policy? Non-owner SR-22 insurance policy is a sort of cars and truck insurance coverage for motorists that do not possess an automobile but are required to have SR-22 insurance policy.

What takes place if I have non-owner automobile insurance policy and also I acquire a vehicle? If you possess an automobile, it is very important to buy the right sort of insurance coverage. A typical automobile plan will certainly cover the damage and also injuries you cause to others. Non-owner automobile insurance coverage do not cover you if you purchase a car.

If you drive other people's cars often, it may be a great idea to obtain non-owner auto insurance. Can you rent a cars and truck without insurance coverage? Yes, you can rent out a cars and truck without having auto insurance coverage. For the most part, rental cars and trucks come with some kind of responsibility insurance coverage that will protect you in case something goes wrong while driving the lorry.

If you borrow cars and trucks periodically, the owner's insurance policy must cover you. If you lease cars or drive somebody else's cars and truck frequently, it could be a good idea to get non-owner vehicle insurance coverage. Can I drive another person's car with my insurance coverage? Yes, you can drive another person's cars and truck with your insurance policy if you have their consent to utilize their vehicle.

Not known Facts About Non-owner Car Insurance Explained - Everquote

In one method or an additional, most small firms require to use a vehicle or vehicle to carry out business - low cost auto. Frequently a sales agent might need to go down off an agreement to a buyer at her workplace. If the agent makes use of a company-owned car that is guaranteed by the company and also enters into a crash in the process, business is covered.

If an employee uses his or her auto on any type of errand related to the organization and is involved in a motor car accident, the proprietor of the business can be held liable for related losses. The keywords are "any duty." If a worker is asked to grab a client from the airport terminal, leave a company letter at the message workplace or purchase ink for the printer at the office supply firm, these are all firm tasks, also if they are completed in the staff member's very own automobile.

risks affordable auto insurance perks low cost auto

risks affordable auto insurance perks low cost auto

But remember, while broad coverage terms and also conditions are common in non-owned and employed automobile responsibility insurance coverage, not all plans are alike. For instance, numerous plans omit physical injuries to the worker and to non-employees such as a spouse, youngster or moms and dad who may be in the cars and truck at the time of the crash.

The chauffeur's automobile insurance coverage plan would certainly choose up those prices. Various other plans require company owner to have obligation insurance coverage on their industrial vehicle policies to bring non-owned and also worked with liability insurance, with the exact same financial restrictions of security for both. The very best method to establish what insurance coverage restrictions are needed is to go over the procedures of business with a expert insurance policy representative. cheapest auto insurance.

Non Owner Car Insurance: Best Coverage Available - Dollar ... Can Be Fun For Anyone

Non-owner car insurance offers responsibility protection to drivers that have a license yet don't own an automobile. If you obtain or lease cars often, use car-sharing solutions like Zipcar or require to submit an SR-22 or FR-44 without an auto, non-owner vehicle insurance policy could be right for you. Below's what we'll failure: What is non-owner auto insurance policy? Non-owner automobile insurance coverage is an insurance coverage plan for individuals without a cars and truck.

cheap car insurance cars insurers car

cheap car insurance cars insurers car

What does non-owner cars and truck insurance policy cover? Non-owner automobile insurance policy liability insurance coverage covers injury to others as well as building damage.

You can not include various other drivers to the plan. Exactly how does non-owner cars and truck insurance policy job? Non-owner car insurance functions as a. It pays for problems https://carinsurancesouthhouston.z6.web.core.windows.net/ above and also past what a lorry's key insurance coverage covers. Non-owner car insurance plan only cover damage if the key plan's protection limit is much less than the additional coverage (accident).

If your pal has $60,000 of building damages protection or more, your non-owner policy does not apply. Where to acquire non-owner automobile insurance policy Several companies that market standard cars and truck insurance likewise offer non-owner auto insurance, but simply do not market it online. Some insurance companies, like Progressive, only market non-owner automobile insurance to you if you are already an existing consumer.

See This Report about What Is Non-owner Car Insurance And What Does It Cover?

Just how a lot does non-owner cars and truck insurance policy cost? Non-owner auto insurance coverage commonly costs $400 to 600 a year, or regarding the very same as auto responsibility coverage.

The majority of car-sharing business supply motorists some liability protection, it may not be enough for you. You require an SR-22 or FR-44 If you need to file an FR-44 or SR-22 type with your state as a result of a DUI or other driving conviction, non-owner coverage might be a cheap way for you to satisfy your responsibility insurance policy demands.

To prevent all of that, take into consideration buying non-owner coverage. cheaper car insurance. In the scope of things, it could be more affordable to be constantly covered under non-owner car insurance policy instead of leaving a void in your coverage. You offered your cars and truck however have not replaced it If you offered your lorry as well as haven't bought a new one, non-owner car insurance coverage can avoid a lapse in coverage.

credit score cheap risks auto insurance

credit score cheap risks auto insurance

Who shouldn't get non-owner car insurance? Getting non-owner automobile insurance coverage may not be the ideal suggestion if you don't rent or borrow cars and trucks often, or if you plan to obtain a cars and truck for some time. You're borrowing an automobile for an extended period Non-owner vehicle insurance most likely won't cover you if you borrow a lorry for a prolonged amount of time (cheaper auto insurance).

Indicators on Non-owner Car Insurance: What You Need To Know - Vern Fonk You Need To Know

The most effective means to shield on your own in this situation is to have that person add you to their vehicle insurance coverage. Hardly ever borrow or rent automobiles Instead of acquire non-owner car insurance in this scenario, consider using: The insurance coverage the rental or car-sharing business offers. The car owner's insurance policy protection (cheapest).

auto insurance cheaper car insurance credit

auto insurance cheaper car insurance credit

All web content as well as services supplied on or with this website are offered "as is" and also "as available" for use. Quote, Wizard.

Non-owner vehicle insurance policy is insurance coverage for people who do not have an automobile yet sometimes drive somebody else's automobile. You may benefit from this sort of insurance coverage if you often lease a vehicle, obtain a close friend's automobile, or use car-sharing services - cheap auto insurance. Find out just how non-owner automobile insurance coverage functions, what it covers, what it doesn't cover, and why you could need it.

Non-owner insurance protection kicks in after the proprietor's insurance policy protection has actually been tired. Definition as well as Instance of Non-Owner Auto Insurance policy Non-owner vehicle insurance coverage is a kind of individual auto insurance coverage that covers vehicle drivers that do not own the vehicle they're driving.

Not known Factual Statements About Non-owner Auto Insurance - Thams Agency

SR22 insurance policy won't instantly go down when you no more require it. You need to ask your insurance firm to get rid of the filing from your car policy. Get in touch with your state department of automobile to identify the length of time you'll require to carry SR22 insurance. You'll need it for three years in most states.

suvs auto insure cars

suvs auto insure cars

You may be called for to have non-owner cars and truck insurance policy in some certain scenarios, such as if you have a prior history of DUIs. What Does Non-Owner Auto Insurance Cover? Non-owner auto insurance coverage is a kind of car responsibility insurance coverage that covers physical injury if you're located to be responsible for a mishap.

Do I Need Non-Owner Car Insurance? Non-owner insurance policy isn't a typical plan.